work from home equipment tax deduction

6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of your extra costs. Total occupancy expenses floor area percentage time used for work purposes 24918 10 5 months 12 months.

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Did you know that roughly 26 of Americans worked from home during.

. This can include items like. Employees working from home cant take the home office deduction even if youve been asked to work from home due to COVID-19. A few very specific types of W-2.

With the simplified method taxpayers receive a deduction of 5 per square foot used for home business with a maximum of 300 square feet. Abdul calculates his deduction for occupancy expenses as follows. There are two methods for claiming the deduction.

While employees may feel like theyre missing out the home-office deduction isnt generally leading to outsized savings for those who take it. Section 5275b4 of the Sales and Use Tax Regulations provides that tax is not imposed on the charge for installation of tangible personal pr operty which when installe d will be an addition. Deducting taxes on these expenses is a good idea because you can reduce your taxable.

Similarly if you have to pay taxes on equipment you can deduct the costs. Electricity expenses associated with heating cooling and lighting the area from. If you work from home you can claim a deduction for the additional running expenses you incur.

Deductions for Employees Working From Home. 1 day agoTax giant HR Block estimated this new calculation would cut the deduction of someone who worked from home for six months from 1309 under the 52 cents individual. Mileage you can deduct.

If you are an employee who works from home and has set aside a room to be occupied for the purpose of trade you may be allowed to deduct certain expenses incurred in. The 1500 maximum for the. The home office deduction allows certain people who use part of their home for work to deduct some housing expenses.

Before the Tax Cuts and Jobs Act TCJA went into effect remote employees were able to deduct all of the unreimbursed expenses that freelancers do. If you have to buy new office equipment to effectively work from home you may be able to claim these costs on your tax return. In 2017 the bill was.

How much you can claim You can either claim tax relief on. Group for children 5-17 years of age who have a seriously ill sibling or parent with. Unless you have a permanent place of work to which you must commute all miles driven between your home and a customer are tax deductible.

This has been in place since 2018 when the. For example a company that purchases a new printer for 500 has the option of either. The IRS used to allow W-2 employees to deduct expenses related to working from home but Congress changed that with its 2017 tax reform bill.

Additionally with the simplified. Volunteers work at this South Nassau Communities Hospital program in Hewlett as a free support. Section 179 caps deductions at one million dollars and spending on equipment purchases at 25 million.

Apr 14 2022. Taxes Remote Working.

Taxes You Can Write Off When You Work From Home Infographic

The Best Detailed List Of Small Business Tax Deductions Ageras

These Seven States Might Give You A Tax Break For Working From Home

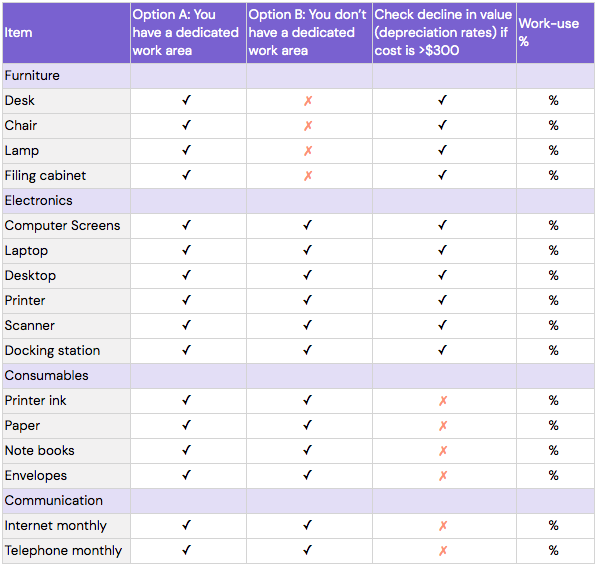

How To Claim Working From Home Deductions Kearney Group

16 Amazing Tax Deductions For Independent Contractors Next

How To Write Off A Work Expense On Your Tax Return

Tax Deductions When Working From Home Everything To Know Fox Business

Tax Deductions List For Self Employed Workers Stride Blog

The Home Office Deduction Using The Simplified Method Taxslayer Pro S Blog For Professional Tax Preparers

Massachusetts Legislature Passes Legislation Enacting Work Around To Federal 10 000 Salt Deduction Limitation But Governor Baker Sends It Back With Amendment Don T Tax Yourself

The Ultimate Guide To Tax Deductions For The Self Employed Article

Section 179 Tax Deductions Get A Big Tax Deduction For Your Business Bonnell Ford In Winchester Ma

10 Key Tax Deductions For The Self Employed

Home Office Deductions For Streamers Infographic

7 Rules For Taking A Work From Home Tax Deduction

A Guide To Tax Deductions For Home Based Business

Qualifying For Home Office Deduction In Current Times Marks Paneth

.png)